Configure sales taxes / VAT

All your taxes live under the Money › Taxes tab. The one applied to an invoice depends on your default tax setting (discussed on this page) and/or which tax you manually apply to an invoice. Taxes will not be added to the invoices of organizations you've marked as tax-exempt, or invoices for their subaccounts.

All your taxes live under the Money › Taxes tab. The one applied to an invoice depends on your default tax setting (discussed on this page) and/or which tax you manually apply to an invoice. Taxes will not be added to the invoices of organizations you've marked as tax-exempt, or invoices for their subaccounts.

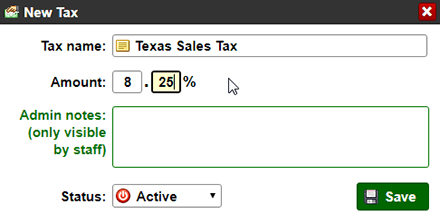

Create a new sales tax or VAT

To create a new sales tax or VAT, go to Money › Taxes, and click on the "Create new tax" button. (To edit an existing tax, you would just double-click on it.) Enter a name for your tax: it will be visible to staff and customers (on their invoice). Enter the tax percentage, and an optional note visible to staff only. Click Save to create the tax.

To create a new sales tax or VAT, go to Money › Taxes, and click on the "Create new tax" button. (To edit an existing tax, you would just double-click on it.) Enter a name for your tax: it will be visible to staff and customers (on their invoice). Enter the tax percentage, and an optional note visible to staff only. Click Save to create the tax.

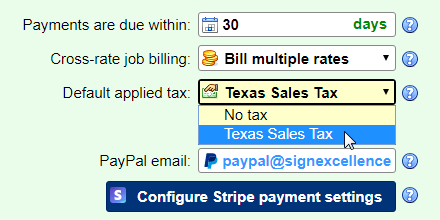

Configure the default tax

To save time, you can pick one of your taxes as the "default tax" in Terpsy: that tax will automatically be applied to invoices, unless the organization being billed is tax-exempt (see next section). Go to Settings › Billing: the "Default sales tax" dropdown determines which sales tax / VAT will be applied to invoices by default. Choose "No tax" to only apply taxes manually to invoices. Click "Save changes" once you're done.

To save time, you can pick one of your taxes as the "default tax" in Terpsy: that tax will automatically be applied to invoices, unless the organization being billed is tax-exempt (see next section). Go to Settings › Billing: the "Default sales tax" dropdown determines which sales tax / VAT will be applied to invoices by default. Choose "No tax" to only apply taxes manually to invoices. Click "Save changes" once you're done.

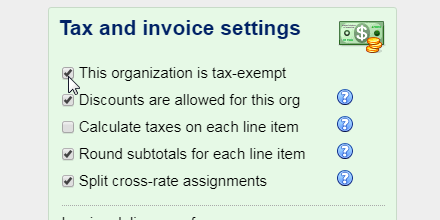

Mark an organization as tax-exempt

Regardless of your default tax settings, you can mark individual customers as tax-exempt, so that no tax is ever applied to their invoices. Note that this setting doesn't just affect the organization itself, but also any subaccounts you might have created under it. Double-click on an organization to edit its profile, and check or uncheck the "This organization is tax-exempt checkbox. Click Save to apply the change: this only impacts future invoices for this organization and its subaccounts. Existing invoices are left unchanged.

Regardless of your default tax settings, you can mark individual customers as tax-exempt, so that no tax is ever applied to their invoices. Note that this setting doesn't just affect the organization itself, but also any subaccounts you might have created under it. Double-click on an organization to edit its profile, and check or uncheck the "This organization is tax-exempt checkbox. Click Save to apply the change: this only impacts future invoices for this organization and its subaccounts. Existing invoices are left unchanged.

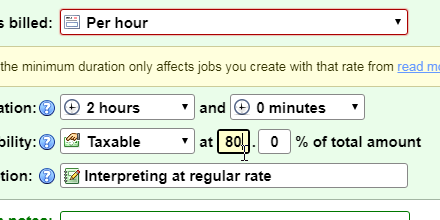

Rate taxability

You can also set your rates to be fully taxable, partially taxable, or not taxable at all. Example: in many states, a consulting gig with a sign language agency would not be taxable. So, even if a customer is not tax-exempt, Terpsy would not apply taxes on rates marked as not taxable. If you've marked a rate as partially taxable, Terpsy would only apply taxes to that percentage of the total for that rate. Learn more about rate taxability.

You can also set your rates to be fully taxable, partially taxable, or not taxable at all. Example: in many states, a consulting gig with a sign language agency would not be taxable. So, even if a customer is not tax-exempt, Terpsy would not apply taxes on rates marked as not taxable. If you've marked a rate as partially taxable, Terpsy would only apply taxes to that percentage of the total for that rate. Learn more about rate taxability.